Startup Financial Projections Template for Funding Success

Use our startup financial projections template to plan your business, impress investors, and secure funding with confidence. Download now!

The Make-or-Break Power of Financial Projections

Financial projections are more than just numbers on a spreadsheet. They tell the story of your startup's future. They're how you communicate your vision to potential investors, showing you understand the market and your path to profitability. This is especially important in the fast-paced startup world, where funding often depends on a compelling financial narrative.

Why Investors Scrutinize Your Projections

Investors are naturally cautious. They look for solid evidence that their investments will pay off. Financial projections provide that proof, turning abstract ideas into measurable metrics. These projections build credibility, especially for early-stage ventures without a proven track record. A well-organized startup financial projections template helps investors quickly assess the viability and potential of your business.

How Projections Shape Strategic Thinking

Creating financial projections isn't just about impressing investors. It’s a valuable tool for shaping your own strategic thinking. The process forces you to define your revenue model, anticipate challenges, and plan for future growth. This proactive approach helps you identify potential roadblocks and adapt your strategy, increasing your chances of long-term success.

For example, forecasting expenses helps you:

- Prioritize spending

- Allocate resources effectively

Startups often use financial projection templates to create detailed forecasts, including:

- Balance sheets

- Income statements

- Cash-flow statements

These templates are essential for attracting investors and planning initial operations. A startup financial projection template might include projections for the next three to five years, covering aspects like funding requirements, revenue growth, and expense management. Learn more about financial projection templates here.

From Enthusiasm to Evidence: The Impact on Funding

Enthusiasm and a great idea are important, but rarely enough to secure funding. Investors need data-driven evidence to back up their decisions. Startups that master financial projections often secure funding 3x faster than those relying on passion alone. Solid projections demonstrate not just your vision, but your business skills and ability to execute.

The Psychology of Confident Projections

Confident financial planning has a powerful psychological impact on investor decision-making. It shows preparedness, foresight, and a deep understanding of the business world. Even pre-revenue startups need strong projections to demonstrate their potential for growth and profitability. This builds investor confidence, making them more likely to believe in your vision and invest in your venture. This confidence translates to a stronger pitch and a better chance of securing the funding you need to grow.

Building a strong financial foundation is essential for any startup. By mastering financial projections, you gain a powerful tool to navigate the startup world, secure funding, and achieve long-term success.

Building Your Financial Blueprint: Template Essentials

A startup financial projections template is the foundation of any successful funding request. It connects your vision with investor confidence, turning a promising idea into a real investment opportunity. But what makes some projections stand out while others fall flat? This section breaks down the elements of investor-ready financial templates, offering insights from seasoned VCs and CFOs.

Key Components of a Winning Template

A strong startup financial projections template needs more than revenue and expense forecasts. It needs to tell a complete financial story, covering the key areas investors examine. These essential components work together to create a clear picture of your startup's potential:

- Revenue Model: Explain how your startup makes money. This includes your pricing strategies, sales channels, and projected customer acquisition costs.

- Expense Budget: List all expected expenses, from salaries and marketing to operational costs and research & development. Even small expenses add up, so be thorough.

- Cash Flow Projections: This is crucial for investors. Project your cash inflows and outflows to show you understand your startup's runway and burn rate.

- Key Metrics and KPIs: Track the metrics that matter most for your business. Examples include customer acquisition cost (CAC), lifetime value (LTV), or monthly recurring revenue (MRR).

- Sensitivity Analysis: Show investors you've thought about different scenarios. This demonstrates an understanding of potential challenges and your ability to adapt.

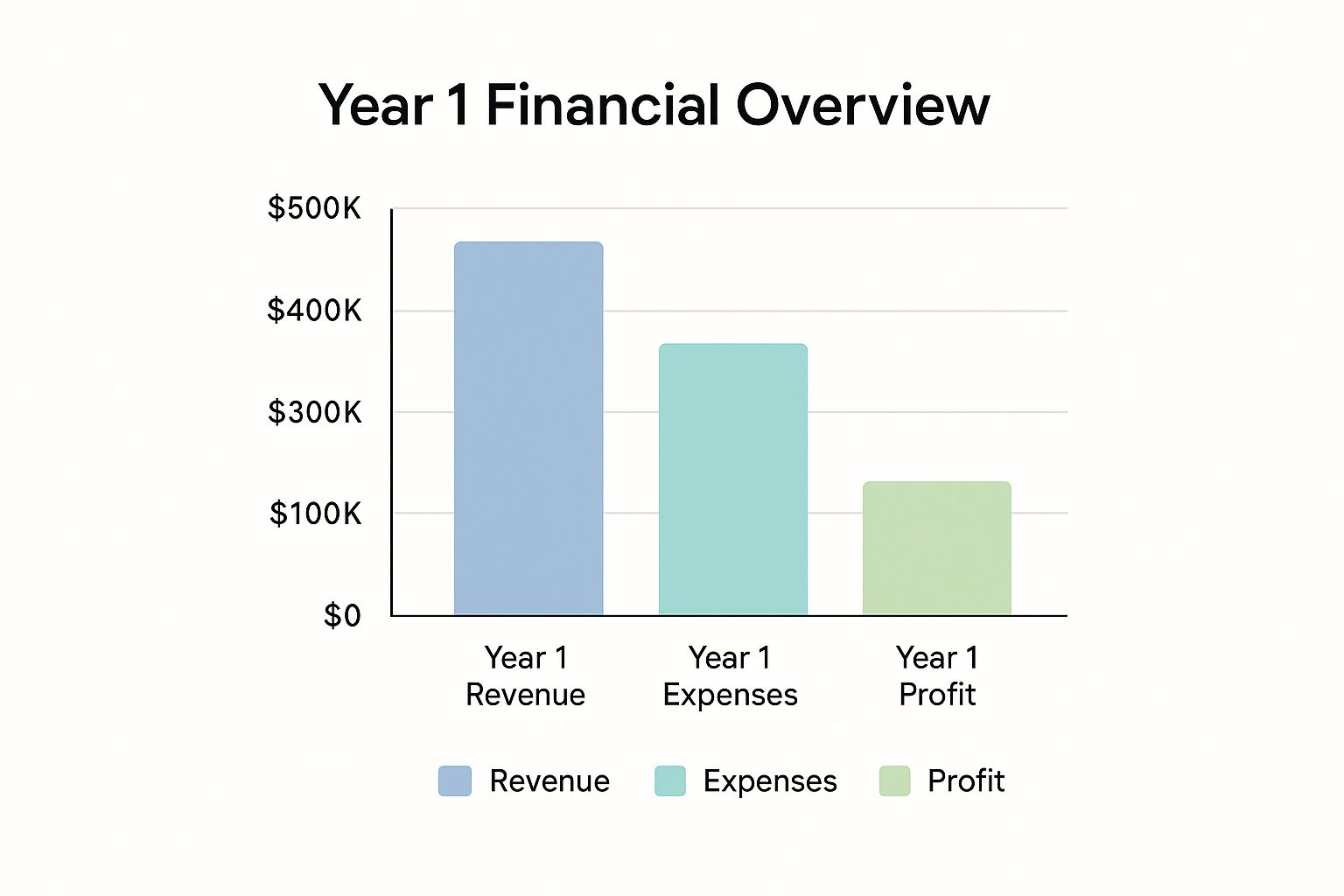

The infographic below shows simplified projected financial data for a startup's first year. It compares projected revenue, expenses, and profit.

As the infographic shows, even with expenses of $400,000**, this startup projects a solid **$100,000 profit in its first year based on $500,000 in revenue. This visualization quickly communicates financial viability and growth potential.

The Importance of Accurate Revenue Forecasting

Accurately forecasting revenue growth is critical for startup financial projections. For example, a startup might use a top-down approach, relying on historical data and market trends to estimate future revenue. As of 2024, many startups use templates with sales forecasting models like the ARR snowball model, which uses historical trend data to project future growth. Learn more about financial projections here. Investors carefully consider the assumptions behind your revenue projections. Make sure these are well-researched and justifiable, demonstrating a deep understanding of your target market and competition.

To help founders understand the key financial components needed at different stages, let's take a look at the following comparison:

Essential Financial Projection Components Comparison: This table compares the essential components of financial projections templates and their importance for different startup stages.

| Component | Pre-Seed Stage | Seed Stage | Series A | Key Metrics to Include |

|---|---|---|---|---|

| Revenue Model | Basic assumptions | More detailed, market validation | Proven traction, unit economics | Revenue growth rate, customer acquisition cost (CAC) |

| Expense Budget | High-level estimates | Detailed departmental budgets | Justification for each expense | Operating expenses, marketing expenses, research and development (R&D) |

| Cash Flow Projections | Basic runway calculation | Detailed cash flow statement | Burn rate, runway, key drivers of cash flow | Cash burn rate, runway, funding needs |

| Key Metrics and KPIs | Focus on key drivers of growth | More specific metrics, early traction | Demonstrated progress towards milestones | Monthly recurring revenue (MRR), customer lifetime value (LTV), churn rate |

| Sensitivity Analysis | Limited scenarios | Multiple scenarios, impact of key assumptions | Robust sensitivity analysis, downside protection | Impact of market conditions, competition, pricing changes |

This table highlights how the level of detail and sophistication for each component increases as the startup progresses through different funding rounds. For example, a basic revenue model is sufficient at the pre-seed stage, while a Series A requires proven traction and a deep understanding of unit economics.

Visualizing Your Financial Story

Your financial projections template is more than just a spreadsheet; it's a story about your startup's future. Use visuals to highlight key metrics, growth trajectories, and potential returns. Charts and graphs can make complex financial data easier for investors to understand and engage with. This is especially important in your pitch deck, where clear visuals can quickly communicate your startup's potential.

Building Investor Confidence

Investor confidence depends on the credibility of your financial projections. Avoid overly optimistic or unrealistic numbers. Instead, present a reasonable and data-backed financial story. Clearly explain your assumptions, demonstrating a thorough understanding of your market and business model. By addressing potential investor concerns upfront and showing a realistic but ambitious growth path, you can build trust and improve your chances of securing funding. Ensure your template is tailored to your specific business and industry. Generic templates often lack the detail needed to impress investors. Consider working with a financial advisor to create a customized template that reflects your unique business model and market opportunity. This personalized approach will show investors you’re serious and understand your financial landscape.

Forecasting Revenue That Investors Actually Believe

Revenue projections are the foundation of any startup financial projections template. They're also where founders often lose credibility with investors. This section explains how to create revenue forecasts that inspire confidence, using insights from Venture Capitalists (VCs) and successful founders.

The Psychology of Effective Revenue Forecasting

Creating effective forecasts is a balancing act. You need to be optimistic and show ambition, but also realistic. Investors want projections based on a solid understanding of the market and realistic assumptions. Projections that are too optimistic can raise red flags and suggest a lack of business sense.

For example, projecting huge growth without explaining how you'll achieve it will likely backfire. Instead, show a realistic but ambitious growth trajectory based on actual market factors.

Forecasting Methodologies for Your Template

There are several forecasting methodologies you can use for your startup financial projections template. Here are two popular approaches:

- Bottom-Up Unit Economics: This approach starts with individual customer behavior. It involves estimating metrics like customer acquisition cost, average revenue per user, and churn rate, then building up to overall revenue.

- Cohort-Based Models: This method groups customers with shared characteristics (like acquisition date) and tracks their behavior over time. This gives a more detailed analysis and can reveal insights into customer lifetime value.

Using these methods makes your projections data-driven and strengthens investor confidence. For more helpful information, check out our guide on testing your business idea.

Segmentation for Demonstrating Market Understanding

Segmenting your revenue projections shows a strong understanding of your target market. Break down your projections by these categories:

- Customer Type: Identify different customer segments and their revenue contributions.

- Channel: Show the projected performance of different sales channels (like online, retail, or partnerships).

- Product Line: If you have multiple products or services, project revenue for each one separately.

This detail shows investors that you’ve thought about your target market and understand what drives revenue growth.

Presenting Multiple Scenarios

Presenting multiple scenarios lets you show your business's potential without undermining your main projection. Develop these three scenarios:

- Base Case: This is your most likely scenario, based on realistic assumptions.

- Best Case: This shows the potential upside if everything goes exceptionally well.

- Worst Case: This shows how your business would perform in difficult conditions.

This approach shows investors you’ve considered different possibilities and are prepared for challenges. It builds trust and shows your financial understanding. However, make sure your worst-case scenario is still realistic and not overly negative.

By mastering these forecasting techniques, you can create a convincing financial story that resonates with investors and improves your chances of getting funding. Remember, your startup financial projections template is more than just numbers; it shows your business knowledge and vision.

Mastering the Expense Side: Beyond the Obvious Costs

Revenue projections are exciting. They showcase the potential of your startup. But accurate expense projections in your startup financial projections template are often the deciding factor in securing funding. This is because expenses directly impact your burn rate and runway, two key metrics that investors carefully examine. This section explores hidden expense categories often overlooked by founders, yet immediately recognized by investors.

Unveiling Hidden Costs: Common Oversights

First-time founders often concentrate on obvious expenses like salaries and marketing. However, several hidden costs can significantly affect your bottom line.

- Professional Fees: Legal, accounting, and consulting fees can accumulate quickly, especially during fundraising or product launches.

- Software and Subscriptions: Monthly SaaS subscriptions for project management, CRM, and other tools can become a substantial expense as your team expands.

- Office Space and Utilities: Even with a remote team, consider the potential costs of co-working spaces or future office needs.

- Travel and Entertainment: Networking, conferences, and client meetings all come with travel and entertainment expenses that need to be included.

- Insurance: Protecting your business with the right insurance coverage (liability, property, etc.) is a non-negotiable expense.

- Customer Acquisition Cost (CAC): The cost of acquiring new customers can vary significantly based on your marketing strategies. Careful calculation and realistic projections are essential.

- Research and Development (R&D): Ongoing innovation and product development require R&D investment, which is often a major expense for tech startups.

- Working Capital: Remember the cash needed for daily operations, such as inventory or covering payment gaps from clients.

The Counterintuitive Benefit of Realistic Expense Projections

It may seem surprising, but investors often favor higher, yet realistic, expense projections over suspiciously low budgets. Underestimating expenses can suggest a lack of experience or, even worse, an attempt to hide potential problems. A well-researched, comprehensive expense model builds credibility. It shows that you've carefully considered the resources needed to execute your business plan.

Validating Your Cost Assumptions

Never rely on guesswork for expense projections. Thorough research is crucial. Here are some techniques to validate your cost assumptions:

- Industry Benchmarks: Research industry averages for expenses such as salaries, marketing costs, and R&D spending. This helps ensure your projections are in line with industry standards.

- Competitor Analysis: Analyze publicly available financial information of your competitors (if any) to understand their spending patterns.

- Supplier Quotes: Obtain quotes from potential suppliers for equipment, software, and other services to get accurate pricing.

- Expert Consultations: Talking to experienced founders or industry experts can provide valuable insights into hidden or unexpected costs.

Strategic Hiring Plans and Growth Milestones

Your hiring plan should directly correspond with your growth projections. Explain how new team members will help achieve specific milestones. This justifies your spending and demonstrates a strategic approach to team building. For example, if you anticipate substantial user growth in year two, explain why hiring additional customer support staff is vital for maintaining user satisfaction. Connecting expenses to growth targets makes every dollar requested justifiable in your startup financial projections template. This careful alignment demonstrates thoughtful financial planning and operational foresight.

Cash Flow Mastery: The Ultimate Investor Trust Signal

For investors, a startup financial projections template isn't just a document; it's a glimpse into your understanding of the business. This section explains how robust cash flow modeling sets apart serious founders. A well-constructed cash flow projection within your startup financial projections template signals financial savvy and potential business sustainability.

A strong cash flow projection demonstrates that you understand the financial health of your business and can plan for its future.

Why Cash Flow Matters to Investors

Investors focus on cash flow because it reflects the actual money entering and leaving your business. Profitability on paper doesn't guarantee a company's ability to stay afloat. A business can show profit on its income statement but still face cash shortages if it doesn't manage working capital effectively. Cash flow projections, however, indicate whether your startup can meet its obligations, fund growth, and handle unforeseen challenges.

For instance, a startup experiencing rapid sales growth might struggle with cash flow if customers are slow to pay invoices. Understanding payment terms, inventory cycles, and other factors affecting cash flow is essential.

Creating Month-by-Month Projections

Developing detailed month-by-month cash flow projections within your startup financial projections template helps you anticipate potential roadblocks. This granular approach allows you to see:

- Seasonal Variations: Prepare for changes in sales and expenses due to seasonality.

- Payment Timing Gaps: Factor in delays between sending invoices and receiving payments.

- Growth-Related Cash Crunches: Understand how rapid expansion can strain your cash flow, even with profitability.

By anticipating these challenges, you can proactively manage your cash flow and avoid potentially crippling cash shortages.

Visualizing Key Metrics

Use visuals to communicate key cash flow metrics effectively:

- Runway: Illustrate how long your existing cash will last based on your projected spending.

- Unit Economics: Show how your cash flow shifts as you acquire and serve customers.

- Profitability Inflection Points: Highlight when your business is projected to achieve positive cash flow.

These visuals quickly convey important data and make your startup financial projections template more engaging for potential investors.

Modeling Different Scenarios

Similar to revenue projections, presenting various cash flow scenarios demonstrates foresight:

- Base Case: Project your cash flow based on your most likely assumptions.

- Best Case: Illustrate the potential cash flow upside in a favorable market.

- Worst Case: Demonstrate how your business would manage its finances in a downturn.

This approach showcases your ability to navigate different situations and helps investors understand the potential risks and rewards. Keep your scenarios realistic and data-driven, avoiding overly optimistic or pessimistic projections.

Key Cash Metrics for Investor Confidence

Specific cash flow metrics are particularly important to investors:

- Operating Cash Flow: The cash generated from your core business activities.

- Free Cash Flow: The cash available after capital expenditures.

- Cash Burn Rate: The rate at which your startup is spending its cash reserves.

- Days Sales Outstanding (DSO): The average time it takes to collect customer payments.

- Days Payable Outstanding (DPO): The average time it takes to pay your suppliers.

Actively monitoring and managing these metrics demonstrates financial discipline and can improve your chances of securing investment.

To understand this better, let's review the following table:

Cash Flow Warning Indicators and Triggers:

| Cash Flow Metric | Healthy Range | Warning Threshold | Danger Zone | Recommended Action |

|---|---|---|---|---|

| Operating Cash Flow | Positive or trending positive | Declining or negative | Consistently negative | Review pricing, expenses, and operational efficiency |

| Free Cash Flow | Positive or trending positive | Declining or negative | Consistently negative | Explore cost-cutting measures and potential fundraising |

| Cash Burn Rate | Sustainable within runway | Exceeding projected burn rate | Rapidly depleting cash reserves | Implement immediate cost reductions and seek emergency funding |

| DSO | Within industry benchmarks | Increasing significantly | Excessively high | Review credit policies and collection procedures |

| DPO | Within industry benchmarks | Declining significantly | Excessively low | Negotiate extended payment terms with suppliers |

This table highlights key metrics, acceptable ranges, and recommended actions if those ranges are breached. It provides a framework for proactive cash flow management.

Mastering cash flow projections in your startup financial projections template gives you a significant advantage. It demonstrates not only financial literacy but also a thorough understanding of your business. These qualities are crucial for attracting investors and achieving long-term success.

Presenting Numbers That Tell Your Startup Story

Financial projections, especially those created with a startup financial projections template, are more than just numbers on a spreadsheet. They're a chance to tell a compelling story about your business. This section explores how successful founders transform complex financial data into engaging narratives that resonate with investors.

Highlighting Key Metrics for Your Business

Every startup has a unique story, and each stage of growth demands different metrics. Early-stage startups often prioritize burn rate and runway, showing investors how efficiently they manage resources while hitting key milestones. Later-stage startups, on the other hand, usually focus on demonstrating growth and profitability.

Knowing which metrics are most relevant to your current stage is key. This knowledge allows you to tailor your startup financial projections template to emphasize the aspects investors value most.

For example, a pre-revenue startup might showcase its strong team, innovative technology, and potential market size. A startup already generating revenue might highlight its customer acquisition cost (CAC), lifetime value (LTV), and projected growth trajectory.

Addressing Investor Concerns Proactively

Anticipating and addressing potential investor questions demonstrates foresight and builds confidence. One effective way to address common concerns is by including a sensitivity analysis in your projections. A sensitivity analysis shows how your business might perform under various market conditions. Incorporating this into your startup financial projections template demonstrates that you've carefully considered potential challenges. Learn more in our article about How to master the product development process.

It's also crucial to clearly explain the key assumptions behind your projections. Don't bury these in the fine print. Highlight them clearly and concisely, demonstrating how they connect to your market research and overall business strategy.

Visualizing Business Potential

Numbers are important, but visuals make your financial story memorable. Use charts and graphs within your startup financial projections template to bring key trends to life. A graph showing a declining burn rate alongside rising revenue, for example, instantly communicates financial health and growth potential. This visual storytelling engages investors and helps them quickly grasp your startup's trajectory.

Mastering the Art of Communication

Presenting your financial projections requires a delicate balance of confidence and realism. Be prepared to discuss your numbers in detail. Develop compelling talking points around each key metric, explaining not just the "what," but the "why."

For example, instead of simply stating, "Our projected revenue is $1 million next year," add context: "Based on our expanding user base and the increasing adoption of our premium features, we project $1 million in revenue next year." This added detail gives your projections more weight.

Benchmarking for Market Positioning

Putting your projections into context by comparing them with industry benchmarks makes your story even stronger. If your projected growth exceeds the industry average, highlight this competitive advantage. If your projections fall below average, be ready to explain why. Perhaps your niche market has a slower growth rate but higher profitability. The key is to show a thorough understanding of your market position, demonstrating to investors that you've done your homework.

By crafting a clear and compelling financial story within your startup financial projections template, you transform raw data into a powerful tool for attracting investment and reaching your business goals.

Ready-to-Use Templates for Every Startup Stage

A startup financial projections template can be the difference between securing funding and missing out. Building these projections from scratch can be time-consuming and complex. This is where ready-to-use templates come in handy. They offer a solid foundation, saving you valuable time and effort, allowing you to focus on refining your unique financial story.

Choosing the Right Template for Your Stage

Not all templates are created equal. Different startup stages require different levels of detail. A pre-seed startup needs a simpler template focusing on cash flow, expenses, and revenue.

Seed-stage businesses benefit from templates that include marketing, sales, and product data, enabling high-level unit economics calculations.

For Series A and beyond, more complex templates are necessary. These should incorporate detailed revenue projections, payroll, assumptions, costs, P&L statements, cash flow, and unit economics.

Choosing a template aligned with your business model is crucial. A SaaS business needs a different template than a hardware or biotech startup. For example, a SaaS template might emphasize Monthly Recurring Revenue (MRR), while a hardware template might focus on inventory management and cost of goods sold. This ensures your projections are relevant and reflect the unique dynamics of your industry.

Customizing Templates for Your Business

While ready-to-use templates offer a valuable starting point, customization is key. You need to adapt the template to reflect your specific business, market, and growth strategy. This involves:

- Modifying Key Assumptions: Don't just accept the default assumptions. Research your market, analyze your competition, and adjust the assumptions to match your reality. This is particularly important for factors like customer acquisition cost (CAC), customer lifetime value (LTV), and sales growth rate.

- Adding Unique Metrics: Most templates cover standard financial metrics. However, your business might have unique Key Performance Indicators (KPIs) crucial for success. Don't hesitate to add these to your template, ensuring you can track and project the metrics that matter most. For more startup ideas, check out Business Ideas DB here.

- Maintaining Consistency: As you customize, ensure your changes don't break any formulas or create inconsistencies in the template. This is especially important for linked spreadsheets and complex calculations. Double-check everything to ensure accuracy and consistency.

Complementary Tools for Enhanced Projections

Beyond the core startup financial projections template, several complementary tools can enhance your financial planning:

- Scenario Modeling Tools: Test different scenarios (like "best-case," "worst-case," and "base-case") to understand the impact of various factors on your projections. This allows you to anticipate challenges and prepare for different outcomes.

- Pitch Deck Integration: Seamlessly integrate your projections into your pitch deck to create a compelling narrative that resonates with investors. Visualizations and clear explanations of key metrics are essential for effective storytelling.

- Investor-Ready Visualization: Present your financial data in a visually engaging and easy-to-understand format. Charts, graphs, and infographics can help investors quickly grasp your key metrics and growth trajectory. Tools like Microsoft Excel or Google Sheets offer various visualization options.

Quality Checking Your Projections

Before sharing your startup financial projections template with investors, rigorous quality checks are essential.

- Internal Review: Have your team review the projections to ensure they align with everyone's understanding of the business. Fresh eyes can catch errors or omissions.

- Expert Consultation: Consider having a financial advisor or mentor review your projections for valuable feedback. They can offer insights into industry benchmarks and investor expectations.

- Sensitivity Analysis: Conduct a thorough sensitivity analysis to check how changes to key assumptions affect your overall projections. This helps identify areas of potential risk and proactively address investor concerns.

Ready to streamline your financial planning? Explore Business Ideas DB here for resources and insights to fuel your startup journey.

Explore More Ideas

Want more ideas like this? Check out Business Ideas DB for consumer app ideas backed by market research.

Explore Ideas