How Much to Start a Business in 2025: Budget Tips & Costs

Wondering how much to start a business? Discover key startup costs and budget tips for launching confidently in 2025. Get your plan started today!

Thinking of Starting a Business in 2025?

Wondering how much to start a business? This listicle provides a clear breakdown of the essential costs involved in launching a venture in 2025. Understanding these costs is crucial for developing a sound business plan and securing funding. From legal fees and location costs to marketing, staffing, and working capital, we'll cover eight key areas to help you estimate your startup expenses. Knowing how much to start a business empowers you to make informed decisions and increases your chances of success. Let's dive in.

1. Business Registration and Legal Fees

One of the first things you'll encounter when figuring out how much to start a business is the cost of making it legal. Business registration and legal fees are essential upfront investments for any new venture. This involves navigating various registration processes, obtaining necessary licenses and permits, and ensuring you comply with all applicable regulations. These costs are crucial to building a legitimate and credible business, impacting how much to start a business overall. They encompass everything from formally establishing your business structure (like an LLC or corporation) to obtaining federal and state tax IDs, and securing any industry-specific permits.

Features of Business Registration and Legal Fees:

- Entity Formation Fees: These vary significantly by state and chosen business structure (LLC, S-Corp, C-Corp, etc.). For example, forming an LLC is generally cheaper than incorporating.

- Trademark Registration: Protecting your brand name and logo involves registering trademarks, costing between $225 and $400 per class of goods or services.

- Legal Consultation: Seeking advice from a legal professional on choosing the right business structure and navigating legal requirements is highly recommended, though it adds to the initial expense.

- Industry-Specific Permits and Licenses: Certain industries, like restaurants, healthcare, or construction, require specific permits and licenses, which can represent a significant portion of your startup costs.

Pros:

- Legal Protection: Formal registration offers legal protection for your personal assets and shields you from certain liabilities.

- Credibility: Being a legally registered business enhances your credibility with customers, partners, and investors.

- Clear Tax Structure: Proper registration sets up a clear tax structure and ensures compliance, avoiding potential problems down the road.

Cons:

- Cumulative Costs: Costs can quickly accumulate, especially if you require multiple registrations, permits, or licenses.

- Ongoing Renewal Fees: Remember to factor in annual renewal fees for licenses and permits in your ongoing operational costs.

- Professional Assistance: Navigating legal complexities might require professional help, adding to your expenses.

Examples:

- Forming an LLC in Delaware is relatively inexpensive, around $90, but carries an annual $300 franchise tax.

- California imposes a minimum $800 annual LLC tax, regardless of profit, impacting how much to start a business in that state.

- Obtaining the necessary restaurant permits in a city like New York can easily exceed $10,000.

Tips for Managing Business Registration and Legal Fees:

- Thorough Research: Research your specific industry requirements and associated costs before finalizing your budget. This will help you understand how much to start a business in your chosen field.

- Consider Legal Services: Utilizing online legal services like LegalZoom for standard formations can help save on attorney fees.

- Factor in Renewals: Include annual renewal fees for licenses and permits in your business plan to avoid unexpected expenses.

- Strategic Location: Some states offer lower registration fees and more favorable tax structures for small businesses, influencing your choice of location.

This step is crucial in the "how much to start a business" calculation because failing to properly register your business can lead to legal issues and penalties down the line. It establishes a solid foundation for your operations and adds to your credibility. By carefully planning and budgeting for these expenses, you can avoid surprises and ensure a smooth start for your new venture.

2. Location and Physical Space

When calculating how much to start a business, the cost of your physical location is a major factor. For businesses requiring a physical presence – whether it's a storefront, office, warehouse, or manufacturing facility – real estate can be one of the most significant startup expenses. This includes not just the monthly rent or mortgage, but also a host of other associated costs. Understanding these costs is crucial when determining how much capital you'll need to launch your venture.

This element deserves its place on the list because it's a recurring, often substantial, expense that can make or break a new business. Failing to adequately budget for location-related costs can lead to early financial strain and hinder growth. Here’s a breakdown of the features to consider:

- Commercial Lease Deposits: Typically equivalent to 1-3 months' rent, this upfront cost needs to be factored into your initial capital requirements.

- Lease or Purchase of Space: This is the core expense, and varies dramatically based on location, size, and the type of property. Are you leasing a small office, renting a retail storefront, or purchasing a warehouse? Each scenario carries different cost implications.

- Property Renovation and Buildout Costs: Getting the space ready for your business operations can involve significant expenses. This might include painting, installing fixtures, building partitions, or more extensive renovations.

- Utility Deposits and Setup Fees: Setting up utilities like electricity, water, gas, and internet often requires deposits and connection fees.

Pros:

- Credibility and Visibility: A physical location lends credibility to your business and increases visibility to potential customers.

- Dedicated Workspace: Having a dedicated workspace separated from your home life can improve focus and productivity.

- Potential Asset: If you purchase the property, it can become a valuable asset over time.

Cons:

- Long-Term Commitment: Leases and mortgages often involve long-term financial commitments, which can limit flexibility.

- Ongoing Costs: Beyond rent or mortgage payments, you’ll have ongoing expenses like utilities, maintenance, and property taxes.

- Limited Flexibility: A physical location can make it harder to pivot your business model or scale your operations quickly.

Examples:

- Flexible Options: Companies like WeWork offer flexible office space solutions starting at $300/month, providing a less committal option for startups.

- Prime Real Estate: Retail space in prime locations like Manhattan can command high prices, averaging $618 per square foot annually. This highlights the importance of careful location selection.

- Humble Beginnings: Amazon, now a global giant, began operations in Jeff Bezos' garage, illustrating how starting small can minimize initial location costs.

Tips for Aspiring Entrepreneurs:

- Co-working Spaces: Consider co-working spaces for initial operations. They offer a cost-effective way to access professional workspace without the burden of long-term leases.

- Negotiate Lease Terms: Carefully negotiate lease terms, including length, renewal options, and improvement allowances.

- Prioritize Foot Traffic (Retail): For retail businesses, prioritize locations with high foot traffic, even if the rent is slightly higher than in less visible areas.

- Factor in All Costs: Don’t just focus on the base rent or mortgage. Factor in all associated costs, including utilities, maintenance, property taxes, and insurance, when determining how much to start a business. This will give you a more accurate picture of your overall startup costs.

3. Equipment and Technology

When figuring out how much to start a business, equipment and technology are key cost factors. Every business, from a small bakery to a tech startup, needs the right tools to operate smoothly. This includes everything from physical equipment like ovens or machinery to computers, software subscriptions, point-of-sale (POS) systems, and reliable communication infrastructure. The specific technology and equipment you’ll need heavily depends on your industry and business model.

For example, a restaurant needs a fully equipped kitchen, including ovens, refrigerators, freezers, and cooking ranges. They'll likely also need a POS system to manage orders and payments. A consulting business, on the other hand, might prioritize investment in laptops, communication software, and project management tools. An e-commerce business will require a robust e-commerce platform, potentially like Shopify, and potentially specialized inventory management software. Understanding these needs is crucial when determining how much to start a business.

This category deserves a place on the list because it's a significant contributor to startup costs. Ignoring these expenses can lead to underestimating the total capital required and could potentially hinder your business's ability to launch and operate effectively.

Features to consider:

- Computer hardware and devices: Laptops, desktops, tablets, printers, and other peripherals.

- Industry-specific machinery or equipment: This could include anything from manufacturing equipment to specialized medical devices.

- Software subscriptions and digital tools: Project management software, accounting software like QuickBooks, CRM systems like Salesforce, and marketing automation tools.

- Communication systems and infrastructure: Phone systems, internet service, and video conferencing tools.

Pros:

- Increases productivity and operational efficiency: The right tools can automate tasks and streamline workflows.

- Enables competitive service delivery and production: Up-to-date technology can give your business an edge in the market.

- May qualify for tax deductions or depreciation: Many business equipment and technology expenses are tax deductible, reducing your overall tax burden.

Cons:

- High initial investment for specialized equipment: Certain industries require expensive machinery, which can be a significant upfront cost.

- Technology quickly becomes outdated: Rapid technological advancements can make your investments obsolete quickly.

- Ongoing costs for maintenance and upgrades: Budgeting for maintenance, repairs, and software updates is essential.

Examples:

- Restaurant equipment for a small establishment can cost anywhere from $50,000 to $150,000.

- Square offers point-of-sale systems starting at $299 plus transaction fees.

- Shopify provides e-commerce infrastructure from $29 monthly.

Tips for Managing Equipment and Technology Costs:

- Consider leasing expensive equipment initially to preserve capital. Leasing can be a more affordable option than purchasing outright, especially for high-cost items.

- Explore refurbished options for cost savings on hardware. Refurbished computers and other devices can offer significant savings compared to buying new.

- Prioritize equipment that directly impacts customer experience or production capacity. Focus on the essential tools that will make the biggest difference in your business.

- Develop a technology replacement schedule and budget for future upgrades. This will help you avoid unexpected expenses and stay current with technology.

By carefully planning and budgeting for equipment and technology, you can effectively manage this crucial aspect of your startup costs and set your business up for success.

4. Inventory and Supplies: A Key Cost Factor When Starting a Business

When figuring out how much to start a business, inventory and supplies are a crucial factor to consider. This cost category can represent a significant chunk of your initial investment, especially for product-based businesses. Understanding how to manage these costs effectively can mean the difference between launching successfully and struggling to get off the ground.

Essentially, this cost encompasses everything you need to create and deliver your product or service. For product-based businesses, this means raw materials, finished goods for resale, packaging, and shipping supplies. Service-based businesses also have supply needs, though they might be less intensive, including office supplies, software subscriptions, and other operational consumables. For example, a restaurant needs ingredients, a consulting business needs presentation materials, and a cleaning service needs cleaning solutions.

This cost area deserves a place on the "how much to start a business" list because it's a fundamental expense for nearly every venture. Failing to account for these costs can lead to a significant shortfall in your startup budget.

Features of Inventory and Supplies Costs:

- Initial product inventory: Crucial for retail or wholesale businesses to meet customer demand from day one.

- Raw materials for manufacturing: The building blocks of your product if you're a manufacturer.

- Packaging materials and shipping supplies: Essential for getting your product to the customer safely and efficiently.

- Office supplies and operational consumables: Necessary for the day-to-day running of any business, regardless of industry.

Pros:

- Fulfillment readiness: Having sufficient inventory allows you to fulfill customer orders immediately.

- Cost savings: Bulk purchasing can often reduce per-unit costs.

- Flexibility: Inventory levels can be adjusted based on market response and demand fluctuations.

Cons:

- Capital intensive: Ties up significant capital that could be used for marketing, hiring, or other growth initiatives.

- Risk of loss: Inventory is subject to obsolescence, spoilage, damage, or theft.

- Storage and logistics: Managing inventory requires storage space and logistical planning, adding further costs.

Examples of Smart Inventory Management:

- Dollar Shave Club: Launched with a lean $35,000 in initial inventory, proving that a large upfront investment isn't always necessary.

- Warby Parker: Initially offered a limited selection of frame styles to control inventory costs and simplify logistics.

- Dropshipping: Models like those used by many Shopify stores eliminate upfront inventory costs altogether by having a third-party fulfill orders.

Tips for Managing Inventory and Supply Costs:

- Start small and scale: Begin with minimum viable inventory and gradually increase stock levels as demand grows.

- Negotiate with suppliers: Secure favorable payment terms with suppliers, such as net-30 or longer, to improve cash flow.

- Just-in-time inventory: Implement just-in-time inventory systems where possible to minimize storage costs and reduce the risk of obsolescence.

- Explore alternative models: Consider consignment arrangements or dropshipping to reduce upfront inventory investment. Learn more about Inventory and Supplies for businesses with low investment.

By carefully planning and managing your inventory and supplies, you can optimize your spending and improve your chances of success when determining how much to start a business. Understanding these crucial cost components allows for a more accurate budget and sets the stage for a smoother launch and sustainable growth.

5. Marketing and Branding: A Crucial Investment When Starting a Business

When figuring out how much to start a business, marketing and branding often gets overlooked, but it's a critical investment. This encompasses all the activities involved in establishing your brand identity and attracting customers. Without a solid marketing and branding strategy, even the best business ideas can struggle to gain traction. This is why understanding marketing and branding costs is essential when determining how much to start a business.

Marketing and branding involve a range of activities, including:

- Logo design and brand identity development: Creating a visually appealing and memorable logo, along with defining your brand's personality, values, and messaging.

- Website development and hosting: Building a professional website serves as your online storefront and is crucial for establishing credibility.

- Digital marketing campaigns (PPC, social media): Utilizing paid advertising and organic social media strategies to reach your target audience online.

- Print materials and signage: Creating physical marketing materials like brochures, business cards, and signage to promote your business offline.

- Content creation and SEO optimization: Developing valuable content, like blog posts and articles, to attract organic traffic to your website and improve search engine rankings. This is crucial for anyone researching how much to start a business, as it helps them find your resources.

Why is this essential when considering how much to start a business?

Marketing and branding are essential for customer acquisition and revenue generation. They help establish your market positioning and differentiate you from competitors. Digital marketing, in particular, allows for precise targeting and measurable ROI, offering valuable insights into the effectiveness of your spending when calculating how much to start a business.

Pros:

- Critical for customer acquisition and revenue generation: Marketing helps you reach potential customers and convert them into paying clients.

- Establishes market positioning and competitive differentiation: Strong branding sets you apart from the competition and communicates your unique value proposition.

- Digital marketing allows for precise targeting and measurable ROI: You can target specific demographics and track the results of your campaigns, allowing for data-driven optimization.

Cons:

- Results can be unpredictable, especially initially: Marketing campaigns can take time to gain traction, and results are not always guaranteed.

- Effective marketing requires consistent investment: Building a strong brand requires ongoing effort and financial resources.

- May require specialized expertise to implement effectively: Certain marketing activities, like SEO and PPC advertising, may require specialized skills or the hiring of external professionals.

Examples of Successful Implementation:

- Dollar Shave Club: Their viral launch video, costing only $4,500, generated millions in sales, demonstrating the power of creative and cost-effective marketing.

- Airbnb: Investing heavily in professional photography of listings built trust and significantly enhanced the perceived value of their platform.

- Casper: Their significant investment in subway and outdoor advertising effectively built brand awareness and drove sales.

Actionable Tips for Aspiring Entrepreneurs:

- Prioritize a professional website as your digital storefront: Your website is often the first impression potential customers have of your business. Make it count.

- Leverage free or low-cost channels initially (social media, content marketing): Start with organic marketing strategies to build a following and generate initial traction.

- Test small marketing investments before scaling successful approaches: Don't put all your eggs in one basket. Experiment with different marketing channels and scale what works.

- Focus on storytelling that differentiates your brand: Connect with your audience on an emotional level by sharing authentic stories that resonate with their values.

Popularized By:

- Mailchimp: A popular platform for email marketing automation.

- Canva: Provides DIY design capabilities for creating marketing materials.

- Google Ads and Facebook: Offer powerful platforms for targeted advertising.

Investing in marketing and branding is not just an expense; it's a crucial investment in the future success of your business. By carefully planning your marketing strategy and allocating appropriate resources, you can effectively reach your target audience, build a strong brand, and ultimately drive revenue. Understanding these costs is a vital part of figuring out how much to start a business.

6. Staffing and Human Resources

Figuring out how much to start a business invariably involves understanding your staffing needs and the associated human resource costs. This crucial aspect often represents the largest ongoing expense for businesses, impacting how much initial capital you'll need and how quickly you can scale. Even solopreneurs frequently outsource certain functions or require part-time help, making this a relevant factor for virtually all businesses. This means carefully considering staffing needs is essential when calculating how much to start a business.

Staffing and human resources encompass all personnel-related costs, including:

- Employee salaries and benefits: This is the most substantial cost for businesses with employees and includes health insurance, retirement plans, and paid time off.

- Contractor and freelancer fees: Utilizing contractors or freelancers can offer a more flexible and often less expensive alternative to hiring full-time employees, especially in the initial stages.

- Payroll taxes and insurance: Employers are responsible for various payroll taxes, including Social Security, Medicare, and unemployment insurance.

- Recruitment and training costs: Finding and training qualified personnel involves expenses like job postings, recruitment agency fees, and onboarding programs.

Why Staffing Matters in Startup Costs

Understanding your staffing needs is vital when determining how much to start a business. Overestimating staffing can quickly deplete your resources, while underestimating can hinder your ability to meet customer demand and grow. Properly planning for these expenses ensures you can allocate sufficient funds and avoid early financial strain.

Pros of Strategic Staffing:

- Enables business scaling: Bringing on the right people allows you to grow your business beyond your capacity as a founder.

- Brings specialized skills and expertise: You can access specific skills and knowledge that you may lack, improving the quality of your product or service.

- Allows focus on highest-value activities: Delegating tasks frees you to focus on strategic activities crucial for business growth.

Cons of Staffing:

- Significant ongoing financial commitment: Salaries, benefits, and related expenses represent a substantial and continuous financial obligation.

- Legal and regulatory compliance requirements: Navigating employment laws, tax regulations, and other compliance requirements can be complex.

- Management time and potential HR challenges: Managing a team requires time and effort, and you may face HR challenges such as conflict resolution or performance management.

Examples of Successful Staffing Strategies:

- Many tech startups begin with founder-only teams to minimize their burn rate during the initial development phase, thereby reducing the amount they need to start a business.

- Basecamp, a successful project management software company, famously maintains a relatively small team while generating substantial revenue, demonstrating that efficient staffing can contribute to profitability.

- TaskRabbit initially utilized a network of contractors to keep fixed costs low and scale its operations rapidly, demonstrating how contractor-based models can be beneficial in the early stages.

Actionable Tips for Managing Staffing Costs:

- Consider contractors or part-time staff initially before full-time hires: This allows you to test the waters and assess your actual staffing needs before making significant commitments.

- Utilize specialized freelancers for one-off projects (design, development): This can be a cost-effective way to access specific skills without the overhead of full-time employment.

- Budget for true employment costs (20-30% above base salary): Remember to factor in taxes, benefits, and other related expenses when calculating your staffing budget.

- Implement clear systems and documentation to streamline onboarding: Efficient onboarding processes reduce training time and improve employee productivity.

Learn more about Staffing and Human Resources This resource can offer additional insights into addressing various business challenges related to staffing and team building. By carefully considering your staffing strategy, you can effectively manage one of the largest components of your startup costs and set your business up for long-term success. This detailed planning helps answer the fundamental question: "how much to start a business?" in a realistic and sustainable way.

7. Insurance and Risk Management: Protecting Your Investment

When considering how much to start a business, insurance is a crucial, albeit sometimes overlooked, factor. While it might not be as exciting as developing your product or marketing strategy, risk management through proper insurance coverage is essential for protecting your investment and ensuring long-term viability. Failing to account for potential risks can be financially devastating, impacting your ability to continue operations in the face of unexpected events. This is why understanding and budgeting for insurance deserves its place on this list.

Insurance essentially transfers the financial burden of certain risks from your business to an insurance company. You pay a regular premium, and in return, the insurer agrees to cover specific losses as outlined in your policy. This provides a safety net, allowing you to recover and rebuild if unforeseen circumstances arise.

Types of Business Insurance:

Several types of insurance cater to different business needs. When figuring out how much to start a business, consider the following:

- General Liability Insurance: This foundational coverage protects your business from common risks like customer injuries on your premises, property damage you accidentally cause, and advertising injury (libel or slander).

- Professional Liability/Errors and Omissions (E&O) Insurance: If you provide professional services (consulting, design, etc.), this insurance covers claims of negligence, mistakes, or inadequate work.

- Property and Content Insurance: This protects your physical assets, including your building, equipment, inventory, and furniture, from damage due to fire, theft, or natural disasters.

- Workers' Compensation Insurance: Required in most states if you have employees, this covers medical expenses and lost wages for employees injured on the job.

- Cyber Liability Insurance: In today's digital world, this coverage is increasingly vital. It protects against losses from data breaches, cyberattacks, and other online threats.

Pros of Business Insurance:

- Protection from Unexpected Events: Insurance provides a financial cushion to help your business recover from unforeseen circumstances like lawsuits, natural disasters, or accidents.

- Contractual Requirements: Many contracts and commercial leases require specific insurance coverage before you can sign on the dotted line.

- Tax Deductibility: Insurance premiums are often tax-deductible as a business expense, reducing your overall tax burden.

Cons of Business Insurance:

- Recurring Cost: Insurance premiums are a recurring expense that doesn't directly generate revenue, adding to your operating costs.

- Policy Exclusions: Insurance policies have exclusions, meaning certain events or losses may not be covered. Carefully review your policy to understand its limitations.

- Premium Increases: Your premiums may increase over time due to business growth, claims filed, or changes in the insurance market.

Examples of Insurance Providers:

- Hiscox: Offers small business insurance starting around $30/month, making it an accessible option for startups.

- The Hartford: Specializes in business insurance packages, allowing you to bundle different coverages for a potentially lower cost.

- Next Insurance: Provides digital-first insurance for entrepreneurs, offering a streamlined and user-friendly online experience.

Tips for Choosing Business Insurance:

- Work with a Broker: An insurance broker specializing in your industry can help you navigate the complexities of insurance and find the best coverage for your specific needs.

- Consider a Business Owner's Policy (BOP): A BOP bundles general liability, property insurance, and often business interruption insurance into one convenient package.

- Review Coverage Annually: As your business grows and evolves, your insurance needs will change. Review your coverage annually to ensure you have adequate protection.

- Document Safety Procedures: Implementing and documenting safety procedures can sometimes lower your premiums by demonstrating a commitment to risk reduction.

By carefully considering your insurance needs and budgeting appropriately, you can protect your business from potential risks and contribute to its long-term success. This is a critical aspect of understanding how much to start a business and ensuring its sustainability in the long run.

8. Working Capital and Cash Reserves

When considering how much to start a business, it's crucial to go beyond the initial startup costs. You'll need working capital and cash reserves to cover your ongoing operating expenses before your business becomes consistently profitable. This financial buffer acts as a safety net, helping you navigate unexpected costs, bridge potential cash flow gaps, and even seize growth opportunities. Proper capitalization is essential for new business survival, making this a critical factor when determining how much money you'll need.

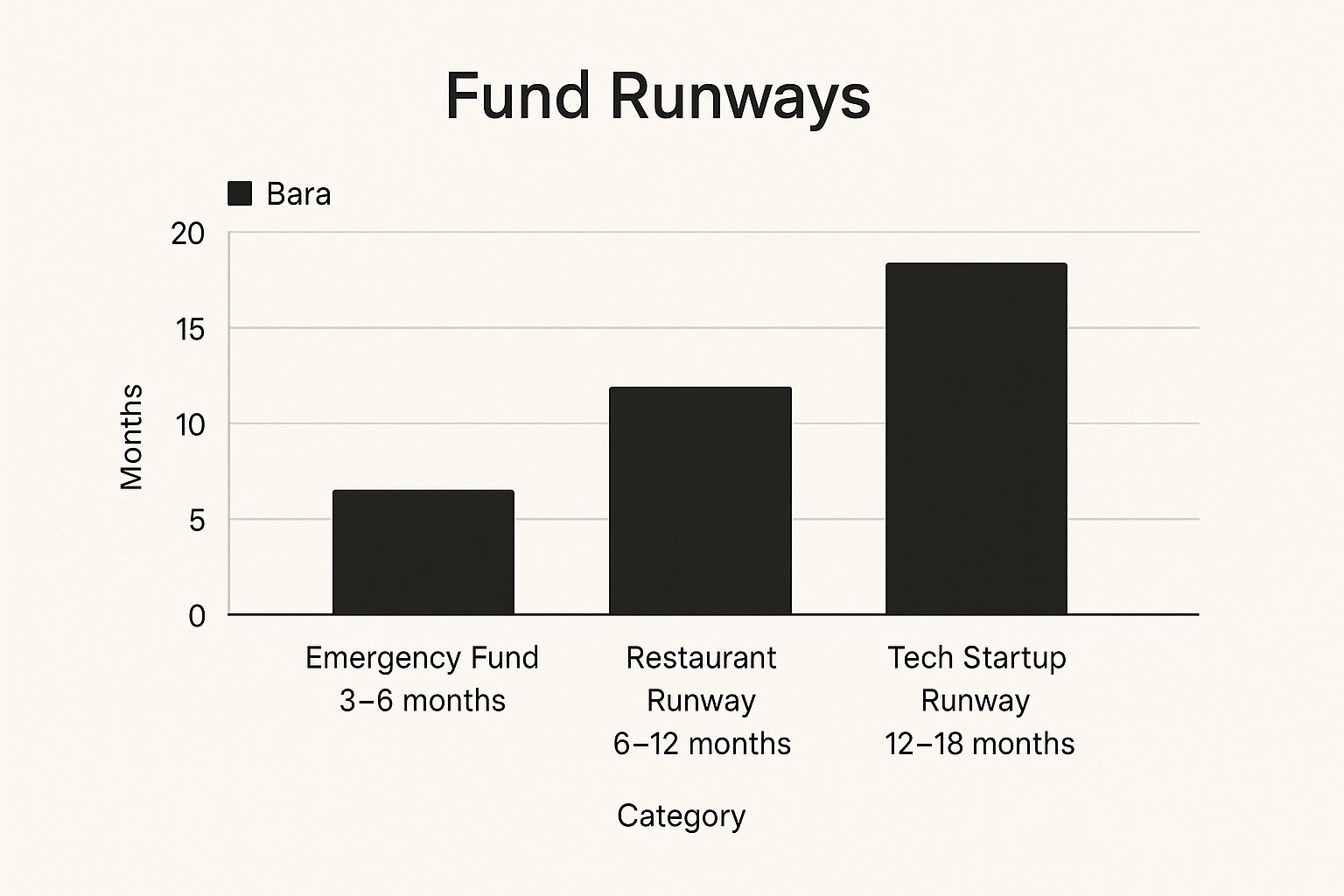

The infographic above visualizes the relationship between working capital, revenue, and expenses over time. It depicts how a business uses its initial working capital to cover expenses during the startup phase before revenue climbs to profitability. The chart clearly demonstrates the importance of having sufficient working capital, highlighting the potential dangers of running out of cash before achieving positive cash flow. The burn rate, represented by the gap between expenses and revenue before profitability, emphasizes the need for accurate financial forecasting.

Working capital provides the following key features: a cash runway for your initial non-profitable period, emergency funds for unforeseen expenses, resources for managing seasonal business cycles, and funding for growth opportunities. The benefits are clear: increased flexibility during the crucial startup phase, reduced stress and improved decision-making, and the ability to capitalize on strategic opportunities and pivots as needed.

However, there are also potential downsides to consider. Idle capital has an opportunity cost, meaning that money tied up in reserves could be invested elsewhere. Building substantial reserves might require taking on debt or diluting equity. Finally, accurately calculating the precise amount of working capital needed can be challenging.

Here are some examples of how different businesses approach working capital: restaurants typically need 6-12 months of operating expenses as a buffer, while many tech startups raise 12-18 months of "runway" through funding rounds. Seasonal businesses like lawn care companies require capital to cover off-season expenses when revenue is low.

Tips for Managing Working Capital:

- Calculate a realistic monthly burn rate: Include all expenses – rent, salaries, marketing, utilities, etc.

- Establish a separate business emergency fund: Aim for 3-6 months of essential expenses.

- Consider a business line of credit: This provides flexible access to capital if needed.

- Develop cash flow projections with conservative revenue assumptions: Don't overestimate early sales.

This aspect of startup planning deserves a prominent place in this list because insufficient working capital is a common reason for business failure. By understanding how much working capital you need and planning for it effectively, you'll significantly increase your chances of success when figuring out how much to start a business. Having a solid financial cushion allows you to focus on growing your business instead of constantly worrying about making ends meet.

Startup Cost Components Comparison

| Cost Component | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Business Registration and Legal Fees | Medium - requires legal knowledge and paperwork | Moderate - possible legal consultation and filings | Legal protection, compliance, credibility | Any new business needing formal structure | Provides legal standing and tax clarity |

| Location and Physical Space | High - long-term lease/renovations | High - rent, deposits, utilities | Physical presence, brand visibility | Businesses needing customer access or workspace | Builds credentials and dedicated environment |

| Equipment and Technology | Variable - depends on industry and tech needs | High - expensive hardware/software | Increased efficiency and competitiveness | Tech-heavy or production businesses | Boosts productivity and service quality |

| Inventory and Supplies | Medium - sourcing and storage logistics | Moderate to high - depends on product scale | Immediate order fulfillment and bulk savings | Retail, manufacturing, product-based businesses | Enables customer delivery and cost control |

| Marketing and Branding | Medium - creative and technical input needed | Moderate - design, ads, digital tools | Customer acquisition and brand positioning | All businesses launching or growing sales | Drives visibility and market differentiation |

| Staffing and Human Resources | High - recruitment, payroll, management | High - salaries, benefits, training | Capacity building and expertise access | Businesses scaling operations beyond founders | Enables growth and skill diversity |

| Insurance and Risk Management | Medium - requires coverage evaluation | Moderate - ongoing premium payments | Asset protection and contract compliance | All businesses requiring risk mitigation | Safeguards against liabilities and losses |

| Working Capital and Cash Reserves | Low - financial planning and monitoring | Variable - depends on operational scale | Financial stability and flexibility | All startups needing runway and cash flow buffer | Provides critical operational flexibility |

Ready to Explore Business Ideas?

Understanding how much to start a business is crucial for any aspiring entrepreneur. From business registration and legal fees to securing enough working capital and cash reserves, we’ve covered the key cost considerations involved in launching a venture. Remember, accurately estimating these expenses—covering everything from location costs and equipment needs to marketing, staffing, and insurance—is fundamental to building a solid financial foundation for your business. Mastering these concepts can be the difference between a successful launch and struggling to stay afloat. By carefully planning your budget and anticipating potential costs, you’ll be better equipped to navigate the challenges of starting and growing a thriving business.

Now you have a better grasp of how much to start a business, the next step is to nail down what kind of business to pursue. Need inspiration? Business Ideas DB can help you discover new startup opportunities backed by actual user complaints, active job postings, and significant market pain points – all crucial information for understanding potential startup costs and market viability. Explore validated business ideas at Business Ideas DB and start building your future today!

Explore More Ideas

Want more ideas like this? Check out Business Ideas DB for consumer app ideas backed by market research.

Explore Ideas